Overview

Overview

DFCC Bank offers a comprehensive range of Treasury products and services delivered by experienced and competent dealers who understand your needs. We understand that in volatile market conditions, every second counts and our dealers go that extra mile to deliver a fast and efficient service. We offer competitive interest rates and exchange rates, when compared to other market participants, enabling you to fulfill your investment and foreign exchange needs with the least amount of documentation and flexible processes, ensuring that you receive a superior experience.

Investment Products

Investment Products

- Treasury Bills

Treasury Bills are a short term investment issued through primary auctions conducted by the Central Bank of Sri Lanka (CBSL) on behalf of the Government of Sri Lanka. They are considered secure investments as the local investor assumes zero default risk. CBSL currently issues T-bills with original maturities of 91, 182 and 364 days.Period Rate 3 Months 8.25% 6 Months 8.50% 12 Months 8.75% - Please call us for attractive rates. 0762637487 / 0762621301

Required documents

- CDS account opening format– For New Clients / One-time document

- BR Format Only applicable New Corporate Clients / One-time document

- Customer Request Letter For every transaction

- Treasury Bonds

Treasury Bonds are issued by the Central Bank of Sri Lanka on behalf of the Government through primary auctions. These Bonds are considered to be medium and long term instruments with zero default risk for local investors.- Interest payments :Semi-Annual basis at the coupon rate.

Year of Maturity Indicative T-Bond interest rate 2026 9.10% 2027 10.00% 2028 10.20% 2029 10.60% - Please call us for more details. 0762637487 / 0762621301

Required documents

- CDS account opening format– For New Clients / One-time document

- BR Format Only applicable New Corporate Clients / One-time document

- Customer Request Letter For every transaction

- Repo on Government Security

Period Below Rs. 500,000/- (P.A.) Above Rs. 500,000/- (P.A.) 1 Week 7.25% 7.50% 1 Month 7.50% 7.75% 3 Months 8.00% 8.25% 6 Months 8.25% 8.50% 12 Months 8.50% 8.75% “Short-term investment opportunity backed by Government securities as collaterals”

Required documents

- CDS account opening format-For New Clients / One-time document

- MRA Format – For New Clients / One-time document

- BR Format Only applicable for New Corporate Clients / One-time document

- Reverse Repo on Government Security

“Short-term borrowing opportunity for existing Government security holders at attractive rates”Required documents- CDS account opening format-For New Clients / One-time document

- MRA Format – For New Clients / One-time document

- BR Format Only applicable for New Corporate Clients / One-time document

*Note: Kindly note that the aforementioned rates only apply to investments up to LKR 50 million. Rates may vary depending on market interest rate movements.

For more information on interest rates on investments above LKR 50 million, please contact Treasury front office on 0762637487 / 0762621301.

FX Products

FX Products

- Foreign Exchange Transactions

DFCC treasury facilitates foreign exchange requirements of customers by offering competitive market rates to meet their needs.Check Foreign Exchange Rates - Forward Foreign Exchange Agreement

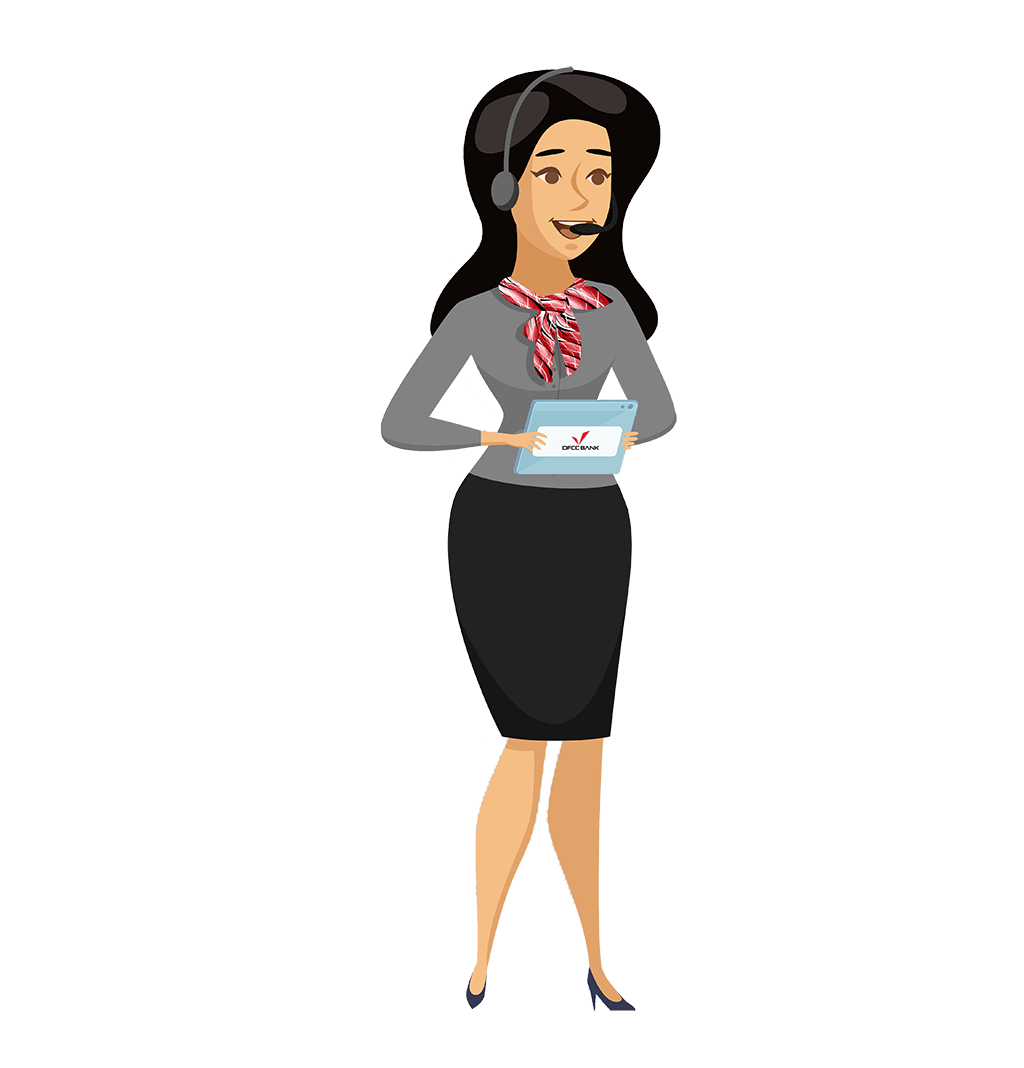

A Foreign Exchange Forward Contract is a binding obligation between the Bank and the customer to buy or sell a specific amount of foreign currency,in order to hedge an underlying foreign exchange exposure,at a predetermined exchange rate on an agreed future date.The following depicts an example of the potential opportunity loss or gain that can occur when an importer or exporter books a forward contract. It depicts the two scenarios when the market spot rate is above or below the fixed forward rate at the time of maturity of a forward. Furthermore, the example assumes a forward rate of 183.00 for 5 months was agreed on the 1st of January for a contract value of USD 100,000/-.

- Foreign Exchange Options Contracts

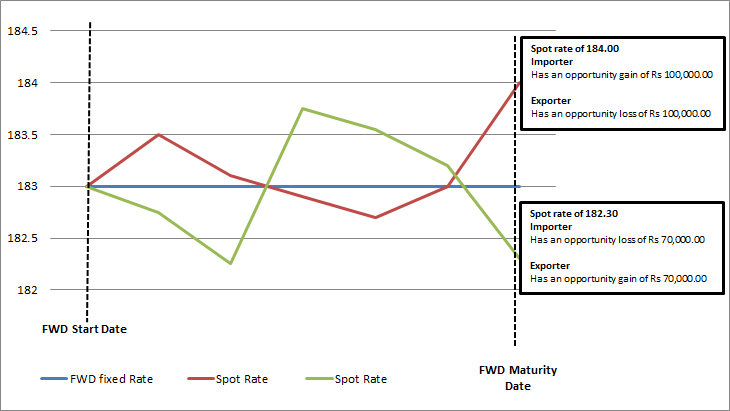

An option is an agreement that gives the buyer, who pays a fee (premium), the right but not the obligation to buy or sell a specified amount of an underlying asset at an agreed upon price (strike or exercise price) on the expiration of the contract (expiry date). A call option is a right to buy the underlying asset and a put option is a right to sell the underlying asset.The following depicts an example of when an importer or exporter books a foreign exchange option contract. The example below depicts the two scenarios when the “market rate” is above or below the “Strike Price” at the time of “Fixing”. The example assumes the customer agreed a “Strike Price” of 183.40 for 5 months on the 1st of January for a contract value of USD 100,000/- when the market spot was 183.00 by paying a premium of USD 500/-.

Required documents

Required documents

Already a DFCC client ?

- CDS account opening format – For Any product

- MRA Format For Repo/Reverse repo transactions

- BR Format Only applicable for Corporate Clients

New Client to DFCC ? Click Here

- Please call us to support the onboarding process

- O76 263 7487

- 076 262 1301

Contacts

Contacts

Treasury and Resource Mobilisation Department

DFCC Bank PLC

No 73/5, Galle Road

Colombo – 03

Sri Lanka.

Treasury Front Office

| Name | Designation | Contact Number |

|---|---|---|

| Sampath Jayasinghe | Vice President / Chief Dealer | 112442780 |

| Kasun Pathirage | Assistant Vice President | 112442777 |

| Nilushika Gamage | Assistant Vice President | 112442782 |

| Thushini Desinghe | Senior Manager / Senior Dealer | 112442781 |

| Sasrika Karalliyadde | Manager / Dealer | 112442774 |

| Nipuna Rathnayake | Assistant Treasury Sales Manager/ Assistant Dealer | 112442771 |

| Ryan Jansen | Assistant Treasury Sales Manager/ Assistant Dealer | 112442778 |

| Samudra Chandrasekara | Assistant Treasury Sales Manager/ Assistant Dealer | 112442773 |

| Charith Jayasundara | Assistant Treasury Sales Manager/ Assistant Dealer | 112442783 |

| Gayathri Samarasinghe | Junior Executive / Junior Dealer | 112442789 |

| Anjanaa Prabagar | Management Trainee / Trainee Dealer | 112442786 |